India Tourism Statistics: A Complete Guide to Trends, Data & Insights

Explore the Insights

- Foreign Tourist Arrivals: The Big Picture (And Its Cracks)

- Where Do Tourists Actually Go? The Destination Breakdown

- The Domestic Tourism Juggernaut

- What the Money Tells Us: Tourism Expenditure & Economics

- The Niche Trends Hidden in the Data

- Challenges & The Data Gaps

- What This Means For You: Traveler or Business

- The Future: Reading the Tea Leaves in the Numbers

Let's talk about India tourism statistics. You've probably heard the big claims – "Incredible India," a land of a billion stories, a tourism powerhouse. But what do the actual numbers say? I remember planning my first trip to Rajasthan, scouring government reports and travel blogs, trying to separate hype from reality. The data tells a more nuanced, and frankly, more interesting story than any brochure.

It's not just about how many people land at Delhi airport. It's about where they go, how long they stay, what they spend their money on, and how the entire sector is shifting. If you're a traveler trying to pick a season, a business looking at opportunities, or just a curious soul, these numbers are your best map. And trust me, some of the trends will surprise you.

Here's the cornerstone: the official India Tourism Statistics report, published annually by the Ministry of Tourism, is the bible for this stuff. It's dense, packed with tables, but it's gold. The latest comprehensive report (the 2022 edition, which mostly covers 2021 data) paints a picture of recovery after the pandemic slump, but it's the longer trends that are truly revealing.

Foreign Tourist Arrivals: The Big Picture (And Its Cracks)

Everyone leads with Foreign Tourist Arrivals (FTAs). The pre-pandemic peak was in 2019, with over 10.93 million foreign tourists. Then 2020 happened, and the numbers cratered to around 2.74 million. The climb back has been steady – 2022 saw about 6.44 million. The government is pushing hard to not just recover but smash the old records.

But here's the thing raw totals hide: the composition. For decades, the lion's share of FTAs hasn't been from the West on six-month spiritual quests. It's from neighboring countries. This is a crucial piece of context most overviews miss.

| Top Source Countries for Foreign Tourist Arrivals (Pre-Pandemic 2019 Sample) | Key Characteristics & Trends |

|---|---|

| Bangladesh & Sri Lanka | Consistently top the list. Travel is often for visiting friends/relatives, short trips, and regional business. A massive volume driver. |

| United States & United Kingdom | The top Western sources. Travel is typically longer, higher-spending, and covers the classic "Golden Triangle" (Delhi-Agra-Jaipur) and beyond. |

| Canada, Australia, Malaysia, Russia | Strong secondary markets. Russia, for instance, has historically been a huge source for Goa's beach tourism. |

| France, Germany, China, Japan | Significant markets with specific interests (French for culture, Germans for adventure, Chinese for group tours pre-pandemic). |

See what I mean? When you hear "India tourism statistics," you can't just think of Western backpackers. The market is incredibly diverse. A tourist from Bangladesh and one from France have vastly different trip profiles, spending patterns, and destinations. The data forces you to break down the monolith.

Long-haul travel from Europe and America took longer to bounce back compared to regional travel. This skews the average spending data in the short term. It's a classic case where one headline number tells you very little.

Where Do Tourists Actually Go? The Destination Breakdown

This is my favorite part. The postcard image is the Taj Mahal. And yes, Uttar Pradesh (home to the Taj) consistently tops the list in terms of domestic tourist visits (a monster market we'll get to). But for foreign tourists? The story spreads out.

Based on the flow captured in India Tourism Statistics and industry surveys, a hierarchy emerges. Maharashtra (Mumbai, Ajanta/Ellora) and Tamil Nadu (Chennai, temples) often compete with Uttar Pradesh for the top spot in foreign visitor footfall. Delhi, as the primary air gateway, is almost always in the mix.

But let's look beyond the top spot. Rajasthan is a permanent fixture in the top five for foreigners – it's the exotic India many dream of. Kerala markets itself brilliantly and captures a premium segment looking for backwaters and wellness. Goa has its own dedicated European charter flight season.

The Rise of the "Second Circle" Destinations

Here's a trend the raw data hints at and anecdotes confirm: tourists are pushing beyond the classics. Himachal Pradesh (especially places like Spiti and Kasol), the Northeast states (like Meghalaya and Sikkim), and Ladakh are seeing disproportionate growth in interest. The numbers are smaller, but the growth rates are steep. This is where you see the shift from large group tours to independent, experience-driven travel.

I spent a month in Himachal once, and the number of Israeli, French, and Korean travelers on hiking trails was striking. They weren't in the big headline FTA counts for the state, but they were there, spending on homestays and local guides. This kind of dispersal is the future, and it's not fully captured in the broad state-level data yet.

The Domestic Tourism Juggernaut

If you only look at foreign arrivals, you're missing about 95% of the story. Seriously. Domestic tourist visits in India are measured in the billions. Yes, billions with a 'b'. In 2019, it was over 2.3 billion domestic tourist visits. Even in 2021, it was around 677 million.

This market is all about pilgrimages, family holidays during school breaks, weekend getaways from big cities, and a growing middle class with disposable income and a desire to explore their own country. States like Tamil Nadu, Uttar Pradesh, and Andhra Pradesh top these lists, heavily driven by religious tourism to temples like Tirupati, Varanasi, and Prayagraj.

The spending patterns are different too. It might be lower per day than a foreign tourist, but the volume is so immense it dwarfs everything else. Any business in the sector that isn't thinking about the domestic traveler is leaving most of the money on the table.

What the Money Tells Us: Tourism Expenditure & Economics

Okay, so people come. But do they spend? The India Tourism Statistics report estimates Foreign Exchange Earnings (FEE) from tourism. 2019 was a record high of about $30 billion. After the pandemic dip, 2022 saw it climb back to roughly $16.5 billion. The aim is to shoot past that $30B mark soon.

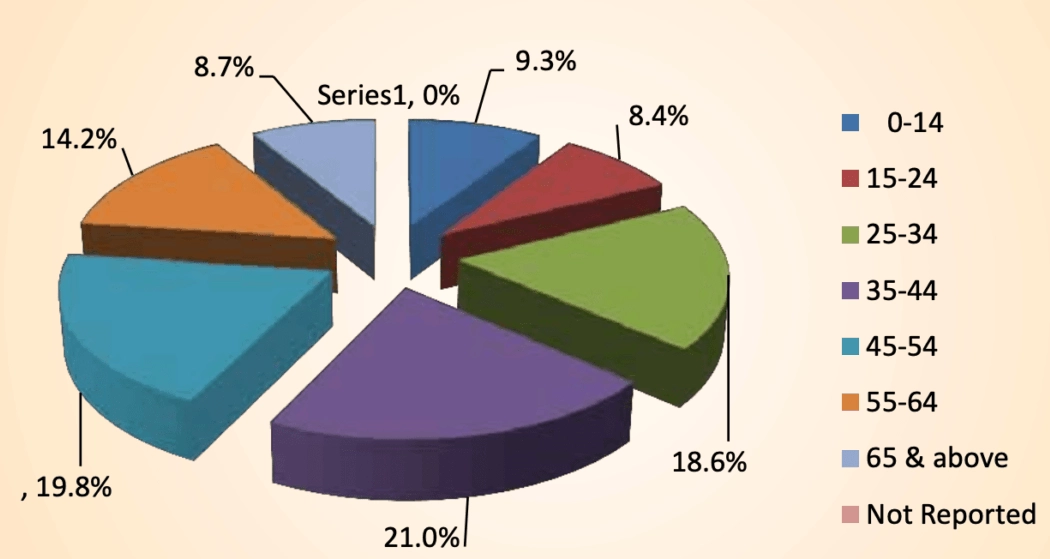

But let's peel that back. The average spend per foreign tourist is a tricky metric. A backpacker on $20 a day and a luxury traveler on a palace hotel tour distort it. Generally, tourists from the USA, UK, and Australia have the highest per-capita spend. Tourists from neighboring South Asian nations, while crucial for volume, have a lower average spend.

Where does the money go? A rough breakdown looks something like this:

- Shopping: A huge chunk. From handicrafts and textiles to jewelry and spices. This is a direct income source for local artisans and small businesses.

- Accommodation: From budget guesthouses to uber-luxury hotels. This sector has seen insane growth, with international chains and boutique homestays all finding their niche.

- Food & Beverage: Both within hotels and at external restaurants. Street food tours are a massive hit now.

- Local Travel & Guides: Taxis, drivers, tour guides, entrance fees to monuments. This is often where the most direct local employment happens.

The government's own surveys, like the India Tourism Survey conducted by the Ministry, try to get into these weeds. It's fascinating stuff if you can find the detailed reports.

The Niche Trends Hidden in the Data

Broad statistics are useful, but the magic is in the niches. Here's what the data whispers if you listen closely:

- Medical Tourism: Rarely the headline, but a massive, high-value sector. Patients from Africa, the Middle East, and neighboring countries come for affordable, quality healthcare. Cities like Chennai, Mumbai, and Delhi are hubs. This isn't captured as "leisure tourism," but it's a critical part of the ecosystem.

- MICE Tourism (Meetings, Incentives, Conferences, Exhibitions): Major cities are competing fiercely for this. It's high-spending, off-season business that fills up large hotel blocks. The government even has a MICE portal to promote it.

- Digital Nomads & Long-Term Stays: A post-pandemic surge. Goa, Himachal, and parts of Kerala are seeing foreigners stay for months, working remotely. Visa policies are slowly adapting, but this is a growing demographic that doesn't fit the old "two-week holiday" model.

Challenges & The Data Gaps

Alright, time for some real talk. Relying solely on official India Tourism Statistics has its limits. The data collection system, while improving, has gaps.

For instance, the Foreign Tourist Arrival count is primarily based on disembarkation cards filled at airports. Land border crossings, especially with Nepal and Bhutan, are harder to track with the same precision. There's also a time lag – the most detailed annual report is often about two years behind the present day.

I cross-reference the official reports with other sources. The UN World Tourism Organization (UNWTO) has global reports that put India in a worldwide context. The State Bank of India's research reports sometimes have great analysis on economic impact. Private sector data from airlines (like monthly passenger traffic reports) and hotel aggregators gives a more real-time pulse.

The other big challenge the data highlights is seasonality. Peaks are insane (October-March, especially around Diwali and Christmas). Shoulders are okay. And the summer/low season (April-June in most places, monsoon in some) sees a dramatic drop. This creates a boom-bust cycle for employment and makes running a tourism business really tough.

What This Means For You: Traveler or Business

If you're a traveler: Use this data to your advantage. Want to avoid crowds? Look at the top destinations list and consider the #6 or #7 spot instead of #1. The infrastructure will still be good, but you'll have more space. Understand the seasonality – yes, it's hot in May, but the hills are lovely and everything is cheaper and less crowded. Your money goes further in the off-season. The data on source markets can also be a clue – if you see lots of tourists from a particular country in a spot, you might find food or services catering to them (which can be good or bad, depending on what you want).

If you're in the business: Look beyond the FTAs. The domestic market is your bedrock. Can you create packages for long weekends from the nearest metro? Can you tap into the pilgrimage circuit with better services? The growth of niche segments (adventure, wellness, wildlife) is outpacing general leisure. The data shows dispersal is happening – are there opportunities in emerging districts rather than saturated city centers?

The Future: Reading the Tea Leaves in the Numbers

Where is Indian tourism headed? The statistics point to a few clear trajectories:

First, volume will continue to grow, both domestically and internationally. The middle class is expanding, connectivity is improving (new airports, better highways, the semi-high-speed rail network), and global interest isn't waning.

Second, travel will become more experience-based and segmented. The era of the one-size-fits-all package tour is fading. You'll see more data on things like wildlife safari bookings, yoga retreat attendance, and trekking permits. Sustainability is moving from a buzzword to a real demand driver, especially among younger travelers from the West and urban Indians.

Finally, technology will reshape how we even measure tourism. Mobile data, digital payments, and online booking patterns offer a much more granular, real-time picture of tourist movement and preference than traditional surveys ever could. The next decade of India tourism statistics might look completely different.

Look, numbers can be dry. But behind every digit in these India Tourism Statistics reports is a person on a train, a family in a temple, a couple on a beach, a guide explaining history, a chef preparing a meal. The data is just the shadow they cast. It's our job to look at the shadow and understand the substance.

And the substance is that India is one of the most complex, challenging, and rewarding travel ecosystems on the planet. The numbers prove it's big. Your experience will prove it's incredible.

Leave A Comment